If you’re a CommBank customer, you might have heard of CommBank Yello – but what does it actually do, and why might it matter if you have (or want) a home loan?

CommBank Yello is not a home loan

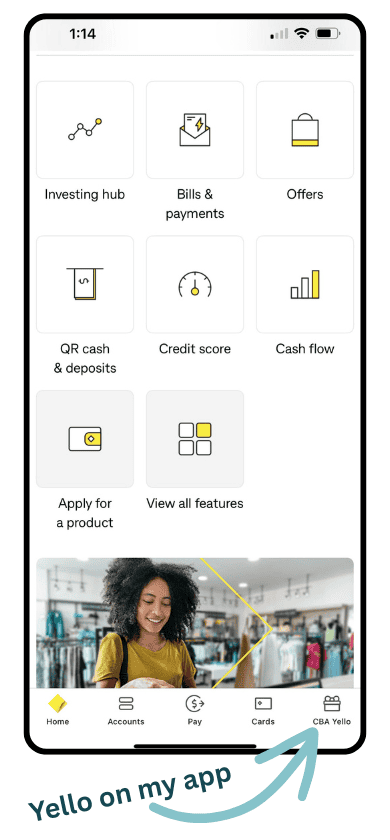

Instead, Commbank Yello is a benefits program designed to reward eligible CommBank customers with tailored offers, cashback, prize draws, and tools to help you get more out of your banking. It sits inside the CommBank app, making it easy to discover and redeem these benefits.

Here is where mine sits on my app:

Rewards for spenders, savers and borrowers

There are different rewards tiers in the CommBank Yello program. These are built around much you transact, save, and if you have a home loan with Commbank. Borrowers can enjoy access to the higher tiers of Gold and Diamond Yello programs.

Commbank Yello can provide cashback amounts for the popular CBA home loan packages.

CommBank Yello benefits touch on many aspects of your lifestyle, not just home loan rewards.

Here are a few Commbank Yello benefits:

- Presale or preferred tickets to selected shows

- Access to exclusive events

- Travel credit incentives in Travel Booking

- Cashback and savings on groceries and entertainment

- Ongoing discounts with More Telecom mobile plans

- Commsec trading cashbacks

- Insurance cashbacks

- Free Kit membership – a family Pocket money app built by Commbank

- Various cashback benefits on Simple Home Loan and Digi Home Loan service fees

- Discounts on NBN plans

- Welcome credits with Amber Electric

- Cashbacks on property settlement services

- Cashbacks on Commbank home energy personal loans when used for purchases with Brighte

Naturally there are plenty or terms, conditions and eligibility criteria – and even a warning that their may be tax implications. You can read more at Commbank Yello here.

Can CommBank Yello help borrowers win?

While Yello itself doesn’t replace good home loan advice, you may find yourself in a position to benefit from the Commbank products you already hold. Put it this way, if your home loan works, and you are happy with how it is meeting your needs – then you should explore CBA Yello eligibility and benefits.

What CommBank Yello doesn’t do:

Who might benefit from Commbank Yello?

The Commbank Yello program suggests your loyalty is something Commbank is working hard to keep.

If you’re already banking with CBA – especially if you have a home loan, credit card or savings account – Commbank Yello could be a useful way to pick up extra rewards and feel more engaged with your banking. It costs nothing to join, and the offers update regularly.

One example is a MAV Package holder who is eligible for Yello Gold could be getting a $4 cash back each month – so why not explore it?

Final word

I don’t recommend choosing a home loan to align with a rewards program – unless of course it is clearly in your best interests. However, if you already have CommBank products you might find that you are eligible for cashbacks, discounts or even prizes so why not explore it?

Commbank Yello can add a nice extra layer of value to being a CommBank customer. And at a time when every little bit helps, cashback and personalised rewards can be a welcome bonus.

To see what’s on offer or check your eligibility, visit the official site here: CommBank Yello.